Read and answer this simple question:

Susan and Jennifer are arguing about whether they should wear seat belts when they ride in a car. Susan says that you should. Jennifer says you shouldn't... Jennifer says that she heard of an accident where a car fell into a lake and a woman was kept from getting out in time because of wearing her seat belt, and another accident where a seat belt kept someone from getting out of the car in time when there was a fire. What do you think about this?

Perhaps it's not so simple now, is it?

Answer this yourself, but keep it in the back of your mind, while you realize the truth...

Human beings SUCK at understanding probabilities... esp. if they are not educated (through no fault of their own).

Human beings are easily influenced into overestimating or underestimating certain probabilities, through time, newsworthiness, and misunderstanding about small possibilities, and outright lies. Here are some of the things psychologists have learned over the years:

Newsworthy Information Affects Perception of StatisticsHuman brain have a cognitive bias called 'availability' bias, in that fresh information, esp. those that captures our attention, such as disaster, death, huge lottery winning, or whatever captures your interest, will cause you to remember the information, and thus, influence your perception of likelihood of future events.

After a natural disaster, demand for insurance goes up, even though probability of disaster had not. People simply are more worried after a widely reported natural disaster.

Similarly, report of a recent disease will raise vaccination rates. After a meningitis outbreak at a major university on the East Coast, vaccine was offered within a week, and 95% of eligible student chose to take the vaccine. On the West Coast, a similar outbreak happened 5 months ago. Due to

FDA approval process, both East Coast and West Coast were given vaccines at the same time. Only 50% of students in the West Coast University chose to take the vaccine. The news is no longer fresh on their minds.

The more a particular risk or statistic is mentioned in recent news or dredged from memory, the more likely it will be weighed more prominently in one's decision process, even when they should not be.

Most scams rely on modern buzzwords to make sure they related to SOME terms in recent news, like "internet", "apps", "VOIP", "web ads", and so on. They want you to think that "tech" companies succeed because tech is mentioned all the time. And in turn, want you to believe their scam will be a 'success'.

Small Probabilities are Rarely Judged CorrectlyEvents of small, tiny, or negligible probabilities are downplayed or outright ignored, esp. when coupled with other biases.

Back in the 1980's when automobile seatbelt wearing became mandatory, many people still resisted wearing them. When questioned, they acknowledge that not wearing seatbelts is not a good idea, but most justified it by stating they don't get into accidents, or they haven't had an accident in many years. Their self-optimism bias made them believe that the small probability of getting into an auto accident is 'effectively zero'.

However, the small probabilities can also be over-weighed, esp. when the events are shocking. For example chances of disasters, such as nuclear reactor melt-downs, or

Liquefied Natural Gas (LNG) transport explosions, airline disasters, or terrorist attacks... or even something like mass shootings, are often vastly over-weighed and perceived to be far more often they they actually are due to media attention. For example, how many nuclear reactor melt downs have been there? Most people can only name 3:

Three Mile Island, Chernobyl, and Fukashima. There actually had been many more (give or take, about 20-30, depending on how you count the ones on-board Soviet submarines). But that's counting 60 years of nuclear reactors, over 400 plants currently in operation, and most of the problems had to do with the earliest (and thus, the less safe) models. Chances of a nuclear reactor melting down is exceedingly small, esp. given modern safeguards. Yet after Fukashima, many nations vowed to close their nuclear power plants and/or severely reduce plans to build them. In this case, news coverage has made the risk look that much larger than before.

Scams leverage this small probability misconception by emphasizing that everybody can be successful without mentioning the odds, usually stated as "if you work hard, you can be successful just like me." The definition of "success", the odds, and the definition of "work hard" are, of course, left vague. They simply neglect to mention that everybody has equal by miniscule odds. Then the scammer will emphasize that the potential victims are making the right choice, how it's a commitment to success, etc. Soon the participants will COMPLETELY ignore the odds that they may be participating in a scam, not a business.

Time Distorts Risk PerceptionsGains, losses, and related risks change over time, but the RATE they change are quite different (and yet more different depending on subject personality, information exposed, and so on).

Gains are remembered far longer than losses, thus gains have much more influence over risk perception than losses. This is called the "

hot-hand fallacy", where people believe that a positive trend will continue, such as "a good basketball player who scored many points in a row will continue to have a 'hot hand'". Human mind enjoy the "near-misses", i.e. "I almost got the jackpot by getting 4 out of 5 cherries on the slots", or "I was one card away from straight flush", and so on, almost as much as actually winning. That's why gambling is often so addictive... people are enjoying the high... of near-misses, and it's these hits and the near-misses that they'll remember, not the dozens and dozens of plays that they lost.

Scammers are quite fond of hot-hand fallacy usually in the form of "what worked for me will work for you", even though the market conditions have changed, what was once a novel item / concept is no longer so.

Scams are also fond of starting to pay early on, to establish a "trend" of "gain" (even though you're just having your own money paid back to you), just so you feel that you're feel like you're on a trend that will not end.

Loss Aversion and Risk AversionHuman beings over-weigh losses to gains by roughly two to one. This affects every part of our decision process, even when we intuitively understand the chances for a loss. This is best explained by the cliche "a bird in hand is better than two in tree."

Scammers are generally very reluctant to talk about loss... or any sort of "negativity". Ponzi pimps virtually never talk about the bad opportunities they had been in, except as some sort of segue into the current opportunity they are pitching (i.e. this one is much better!)

On the other hand, scammers are quick to appeal to your loss aversion, by making bogus promises. A certain

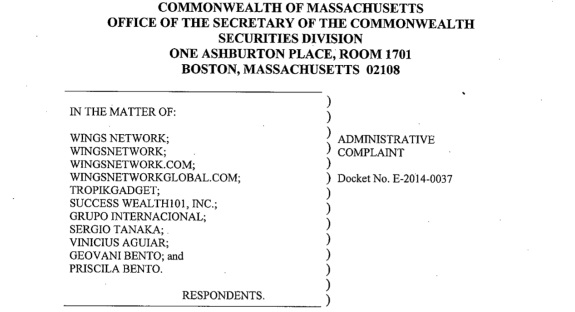

Ponzi scheme in Massachusetts had an "income program" where for additional monthly fee, your income (which can only be earned if you pay them first) is "guaranteed" by a certain other company. Now that the scheme had been shut down, there is no word on did any one got any money from this "guarantee".

Scammers also are quick to borrow every bit of reputation by appealing to anything that seem to have more reputation than the scheme itself, even if they have to exaggerate or outright lie about hotel deals, network with huge airlines, endorsement by certain celebrities, hired big-shot lawyer or spokesman, etc. They are all meant to decrease the

PERCEIVED risk of the company (being declared illegal) because they know you are averse to loss and risk.

Self-Bias and Self-DelusionDo you REALLY remember your past views and decisions? You probably don't. Instead, you have a "narrative" of what you *think* you previously thought.

Ever ran into someone who "always" say "I knew it all along"? That person probably have a distorted view of what s/he previously thought. And this is dangerous, because it a) makes catastrophes and disasters look a lot more predictable (than they actually are) or b) makes catastrophes appear LESS likely due to a series of false alarms.

Scammers will appeal to your self-bias and encourage your self-delusion. If they want to convince you that the scam is not a scam, they will cast any sort of doubt as "false alarm", and thus encouraging you to dismiss the next warning as "cry wolf" (as in the tale "The Boy Who Cried Wolf"). If you ever mention that you didn't join a particular scheme, they will encourage you by saying you've made a great decision and you must be smart even though it was probably just dumb luck and you didn't have money to that join that scam at that time, but this time it will be different! This scheme (scam) is nothing like that one!

Scammers don't merely want to scam you now, they want to make you susceptible to MORE scams so they, as well as their comrades in the Scamworld, can continue to scam you in the future. They want to cultivate the biases and the misconceptions in your mind, so you will no longer see the truth, but their version of the world, where you believe they are offering you salvation, not scamming you.

In Conclusion...Back to that survey question... How do you think kids would react to those questions? It's surprising that it is actually affected by education. Do people recognize that consequence of not doing something is reason enough to actually do that something? Or are the imagined horrifying scenarios, such as 1) You flying through the windshield, 2) got trapped underwater or on fire, going to dominate your thinking regarding seatbelts?

A study polled both summer camp held for "under-privileged kids" and a discovery camp for gifted students. This is the result:

That's right, poor kids don't know anything about probabilities, while rich kids do. And poor kids often end up with NO IDEA what's going on (no overall conclusion).

Now imagine these kids grew up... still not knowing much about probabilities.

That is probability neglect.

Don't let that happen to you.